Introduction

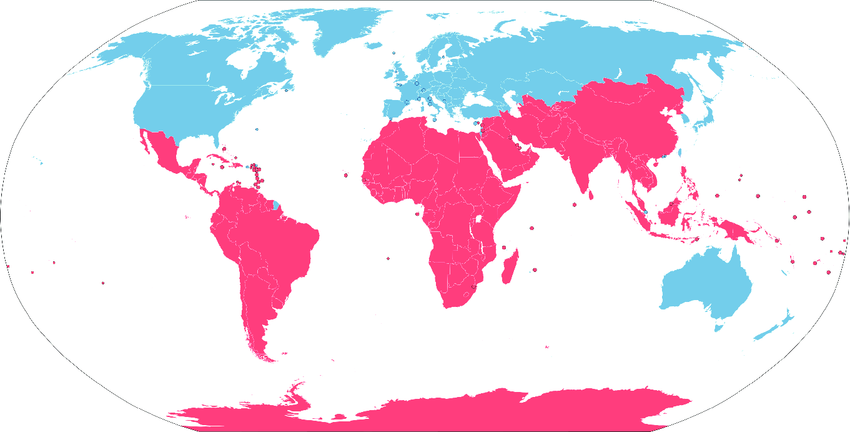

The term Global South refers to a group of countries that are predominantly developing and located either in the Southern Hemisphere or outside the Western bloc. These nations often face significant challenges such as unequal participation in global trade, limited access to advanced technologies, and a dependency on raw material exports.

However, rapid population growth, accelerating urbanization, and widespread adoption of modern technologies have created unique investment and development opportunities. This emerging momentum positions the Global South not only as a beneficiary of globalization but increasingly as a driver of it.

Key Opportunities in the Global South

Within every major challenge lies the seed of a rare opportunity—and the Global South, as a vast landscape of countries with young populations, untapped natural resources, and underdeveloped infrastructures, has emerged as one of the most dynamic and least-contested playing fields for visionary investors and innovators.

This is where the speed of demand growth outpaces existing infrastructure; where digital connectivity is leaping ahead, but financial services, healthcare, education, and energy remain in nascent stages.

This section outlines eight strategic domains where investment can yield not only economic returns but long-term positive impact—especially for players aiming to be more than just sellers, but builders of the future.

- Population Growth and Urbanization

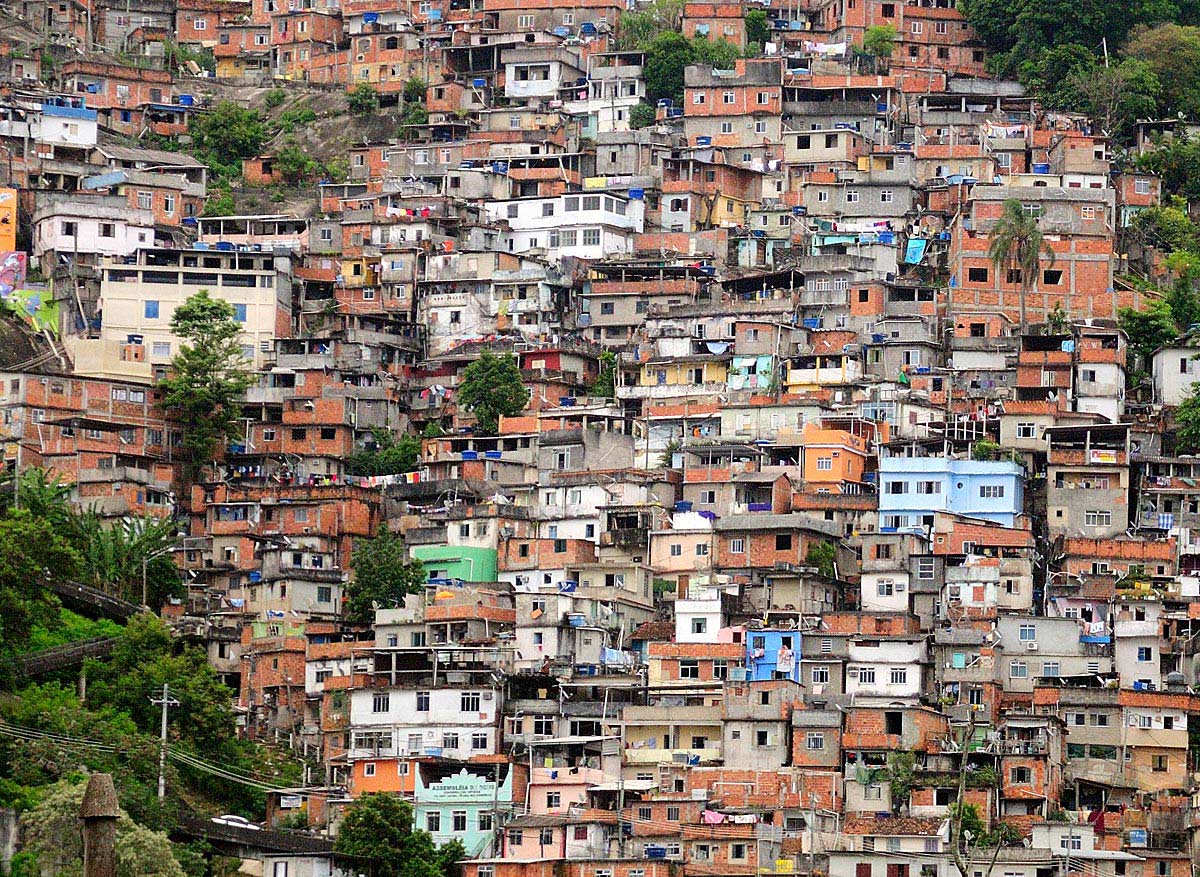

By 2050, over 80% of global population growth is projected to occur in the Global South. This surge increases the need for urban infrastructure, housing, and municipal services. In many countries across the region, cities are not merely expanding—they are experiencing demographic explosions. Megacities like Lagos, Dhaka, and Nairobi are expanding at lightning speed while relying on outdated infrastructure. This gap between growth and capacity represents a golden opportunity to invest in public transportation, smart cities, and affordable housing. - Digital Financial Technologies

A significant portion of the population in these countries lacks access to formal banking services. This reality presents opportunities for the development of fintech solutions, microfinance platforms, and Sharia-compliant banking. In a world where digital transactions occur in seconds, billions still live without bank accounts. While alarming, this fact also reveals a strikingly untapped market—especially in Africa and South Asia—primed for inclusive fintech solutions that deliver not only financial services but a sense of visibility and economic agency. - Smart Agriculture

Land remains one of the most vital assets for communities in the Global South—yet cultivation methods are often outdated, inefficient, and vulnerable. In a world of rising food demand, every smart seed, soil sensor, or weather algorithm is as valuable as gold. Modern agriculture in these regions is not merely about farming—it is about building a climate-resilient future. Leveraging technologies such as AI and blockchain can dramatically enhance agricultural productivity and strengthen food security. - Digital Health

When it takes half a day to reach the nearest clinic, who accounts for the lives lost along the way? In the Global South, digital health is not a luxury—it is a lifeline. The integration of AI, mobile internet, and telemedicine systems can radically expand access to healthcare and save countless lives. Limited access to healthcare in rural areas creates a vital opportunity to develop mobile clinics and online medical consultations. - Digital Education

When there are no schools, no teachers, not even desks and chairs—technology can deliver the future through a mobile phone. With a youthful population eager to learn, the Global South is fertile ground for digital platforms focused on skill-building, language education, and entrepreneurship. Online education platforms can help transfer essential technical and language skills to this rising generation. - Renewable Energy

Villages that go dark at night can be brought back to life with a single solar panel. The Global South needs energy—and it also has vast potential to generate it through clean sources. Investment in microgrids, small-scale solar plants, and waste-to-energy projects in these regions offers both profitability and transformation. Over 700 million people in the Global South still lack access to reliable electricity. Investing in solar and wind energy can help bridge this critical gap. - Emerging Middle Class

In the backstreets of Dar es Salaam, Surabaya, or Casablanca, a new generation is emerging: smartphone-carrying consumers with a strong appetite for quality and new experiences. Though their incomes may be modest, their expectations are rising. These emerging markets are poised to become the next homes for brands that can speak their language—both culturally and commercially. Rising incomes in countries like Nigeria, Indonesia, and Egypt are generating new demand for consumer goods and services. - Young Workforce

In the Global South, there is no shortage of people seeking jobs—what’s lacking is planning and entrepreneurship. With a young and employable population, proper training can not only power local economies but connect these workers to global supply chains. This is where upskilling in digital freelancing, software services, and business process outsourcing (BPO) becomes critical. The young, trainable workforce offers ideal conditions for developing the gig economy and BPO ecosystems.

(The gig economy refers to a labor market where individuals work on short-term, freelance, or project-based contracts instead of full-time jobs—such as drivers, translators, designers, online tutors, or platform-based workers like those on Uber, Fiverr, and Upwork.)

Strategic Pathways for the GCC Private Sector and Traders

While governments draw the macro-level roadmaps, it is the private sector that must pave the way and build the ecosystems. Engagement in the Global South is no longer just about exporting or investing; it is about creating sustainable value chains, building localized brands, and acting as development partners.

In a world where major competitors enter the field with vast resources, the only successful traders will be those who approach these emerging markets with regional vision, technological mindset, and smart operational structure. This section offers four specific and practical pathways that can transform GCC private sector engagement in the Global South from scattered activity into a transformative strategy:

1. Becoming a Smart Investor and Technology Partner

In today’s world, capital alone is no longer sufficient. Successful companies are those that blend capital with technology and localized models. In the Global South, the winner is the one who doesn’t merely chase money but identifies opportunities to create value and activates them through local partnerships.

2. Building Localized Brands

The Global South does not only need capital—it needs brands that resemble its own identity. GCC traders, with a deep understanding of the cultural, religious, and behavioral dynamics of these markets, can design brands that both earn local trust and deliver global quality. This combination is the master key to young markets.

3. Developing Supply Chains in the Global South

Controlling the supply chain means controlling the future. The Global South can become the smart, cost-effective, and flexible workshop of GCC brands—but only through building production structures, training human capital, and intelligent integration with regional logistics systems.

4. Becoming Platform Builders or Ecosystem Enablers

The greatest influence is achieved through building soft infrastructures. Traders who create local ecosystems (accelerators, innovation hubs, service platforms) shape not only the market, but also the mindset of the next generation of entrepreneurs in the Global South. This means sustainable influence and building soft power.

Successful Case Studies

Every strategy only gains meaning when it can be tested in practice and its success demonstrated. On the path to entering the Global South, there are examples that show how the private sector in GCC countries has managed to create lasting and profitable impact through smart decisions—going far beyond mere financial investment.

These examples serve as a blueprint for those aiming to generate a combination of economic profit, geopolitical influence, and shared value in the Global South with a long-term vision. This section examines two prominent case studies, each offering key lessons for future planning and modeling:

1. IRH (UAE) Investment in the Mopani Copper Mine in Zambia

With a $1.1 billion investment, 51% of Mopani Copper Mine shares were acquired, leading to regional economic development and stronger ties between the UAE and Zambia.

2. ACWA Power (Saudi Arabia) Investment in Renewable Energy

By implementing various renewable energy projects in countries such as South Africa, Morocco, and Uzbekistan, this initiative contributed to the expansion of clean energy and the transfer of technology.

Hidden Strategic Opportunity: Exporting GCC’s Indigenous Development Models

In the global competition to penetrate the Global South, many actors are simply aiming to capture markets. But true distinction lies not in physical presence, but in modeling mental and cultural frameworks. Unlike other global players, the GCC countries possess a unique advantage: a successful blend of Islam, technology, targeted migration, and localized digital development experience.

If correctly formulated and exported, this development model could serve as the soft-power nucleus of Gulf influence in the Global South. In places where neither the Western nor Chinese model can be easily replicated, the GCC countries can position themselves as trustworthy guides, partners, and development role models.

Beyond physical infrastructure investments, the GCC can export human development models and localized digital economy frameworks. These include:

- Islamic digital banking

- Technical education and skilled migration programs

- Arabic e-commerce platforms

- Halal fintech ecosystems

Creeping Threat: Growing Dependence on Unstable Markets

Opportunities are often just the flip side of risks. Many GCC projects in the Global South are implemented in regions that, on the surface, appear highly attractive—but beneath the surface suffer from structural instability and institutional weaknesses.

The real danger lies in threats that are hidden, gradual, and cumulative—not immediate or easily identifiable. If these threats are not properly managed, they may result not only in economic losses but also in reputational damage and a decline in the strategic trust placed in GCC countries.

Recognizing these risks is the key to survival and the precondition for sustainable influence.

Investing in countries with political and economic instability can lead to asset seizure or expropriation, international credit risks, and weak project execution.

Smart Protective Framework for GCC Investment

Investing in the Global South is not just an economic play—it is a complex contest of profit, stability, security, and strategic foresight.

For the GCC countries to safeguard their interests, goodwill and generic agreements alone are not enough. They must build an intelligent, multi-layered protection architecture that simultaneously mitigates legal, political, currency, and operational risks—while providing a safe and enabling environment for long-term investment.

This protective framework will be the distinguishing line between investors merely seeking returns and those aiming to build enduring power in emerging economies.

The minimum dimensions of this framework should include:

- Legal Protection:

Utilize bilateral investment treaties and international arbitration clauses. - Financial Protection:

Hold revenues in strong currencies and use forward exchange contracts. - Political Protection:

Leverage political risk insurance and partnerships with international institutions. - Operational Protection:

Apply rigorous auditing controls and phased payment structures.

Lessons from China’s Investment Mistakes in the Global South

China is undoubtedly one of the most influential players in the Global South; yet great success does not always equate to flawlessness. On its path to expanding influence across Africa, South Asia, and Latin America, China has committed several strategic missteps—some of which still bear political, financial, and social consequences.

For GCC countries, these experiences are invaluable—provided they are properly analyzed. Smart foresight means learning from others’ failures before paying the price yourself. This section examines three of China’s most critical errors, where poor project design, lack of transparency, and neglect of political-social sustainability led to immense costs and loss of influence.

- Kenya Railway Project:

The project, financed by heavy Chinese loans, resulted in increased debt for Kenya and growing public distrust. - Hambantota Port in Sri Lanka:

Due to poor profitability, the port was leased to a Chinese company for 99 years, raising global concerns over China’s lending practices. - China-Pakistan Economic Corridor (CPEC):

Faced with a lack of financial transparency and growing debt, the project has threatened Pakistan’s economic independence.

Conclusion

The Global South is no longer a raw and unstable territory for global actors—it is evolving into a playing field for future civilization-building. The future belongs to those who realize early:

The Global South is not just looking for capital—it is looking for intelligent, trustworthy, and inspiring partnership.

Now is the time for Gulf actors to redefine themselves—not merely as investors, but as architects of future development in the Global South.

The Global South is the primary ground for wealth creation and commercial future-building. GCC countries—especially their private sectors—are uniquely positioned to play a pivotal role in this region. By leveraging international experience and implementing smart protective frameworks, they can navigate the risks of the Global South and create lasting competitive advantages.

Write your comment.